Now’s the Time for Electronics OEMs to Shape Their Futures

In view of the COVID-19 disruption and anticipated aftermath in the embedded electronics industry, computer board OEMs face an existential challenge right now: How do they best allocate their resources to satisfy the competing objectives of 1) sustaining existing designs while simultaneously 2) inspiring and capturing the market for new designs?

If OEMs spend too many resources on sustaining old designs, they risk losing out to competitors on new design wins. If they focus too much attention on introducing new products and leave customers dependent on older designs in the lurch, they risk losing those customers.

No one knows what the new normal will look like after the immediate pandemic fallout, but successful companies will be keeping an eye on the future while they navigate their urgent crisis response.

Here are some practices that electronics OEMs should consider adopting immediately, both to weather the current COVID-19 storm and to position themselves for fast sailing when things improve.

Differentiate between the immediate health crisis fallout and the long-term economic recovery

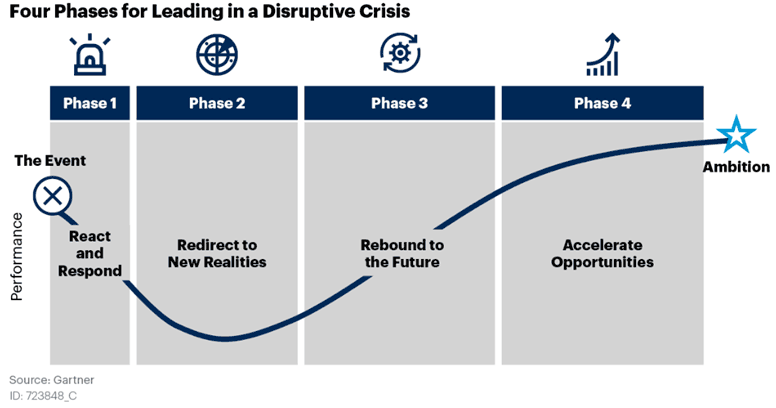

While it’s easy to get sucked into making changes in response to the current crisis, it’s important to consider how reactive decisions support or weaken long term success. Gartner suggests a perspective and mindset that OEMs should adopt when considering immediate decisions as well as long-term strategy.

Right now, large capital equipment manufacturers in critical sectors are dealing with supply chain instability as their suppliers experience pandemic fallout. Other equipment makers are seeing order delays, either because their customers’ demand has slowed, or they’re focusing their efforts on their immediate struggle to survive.

At the same time, equipment end users like the DoD are figuring out how to handle the effects COVID-19 has on defense supply chains. This challenge is complicated by the fact that many defense systems rely on commercial parts that are also sold to nondefense commercial customers—many of them severely affected by the pandemic.

During this immediate period, while the DoD moves to shore up its supply chain, manufacturers who make and use embedded computer boards are likely to see a delay in their pipelines. They may even see an increase in RFQs for old designs, many of which will have obsolete parts and may themselves already be “obsolete.”

Soon after this initial reflex action to shore up vulnerable supply chains (and while the trauma is still fresh in everyone’s mind), I predict the DoD and commercial equipment makers will redouble and accelerate their efforts to radically streamline their acquisition and modernization capabilities, while simultaneously changing how they sustain their legacy systems, to do more with fewer resources.

Regardless of how the wider economy rebounds, there is evidence that there will be a significant volume of new projects and design-win opportunities. NDIA reports that approximately $160 billion have been authorized and appropriated by Congress but not yet obligated to individual contracts.

The companies who win these contracts will be the ones positioned to quickly respond to these opportunities. The companies without the resources to win this work will find themselves left behind.

As everyone navigates through the fallout of the COVID-19 pandemic, people should take care not to fall back into old practices. Instead, they should consider how the pandemic’s aftermath could unfold and how they want their response to look.

Stay healthy and safe, everyone.

Ethan Plotkin, CEO, GDCA Inc.

P.S. I’m sharing my company’s sustainment approach to survive Phase I in our Critical Thought: “5 Actions Teams Must Implement Into Their COVID Response Right Now”